38+ Ultra High Net Worth Legacy Planning

1035 Exchanges for Life Insurance. 38 open jobs for Ultra high net worth client consultant in United States.

The Growing Drive To Wealth Estate Legacy Planning Amongst Mainland Chinese Hnwis And Uhnwis Asian Wealth Management And Asian Private Banking

High net worth estate planning may require using strategies such as the 1035 exchange for life insurance due to potentially.

. Why Succession Planning Is. Web Financial management for high net worth individuals involves 5 core aspects of building a profitable portfolio tax planning income planning investment planning real-estate. Web Great question.

Web Search Ultra high net worth client consultant jobs in United States with company ratings salaries. It depends on who you ask. Web According to Wealth-Xs Preparing for Tomorrow.

Web During the Great Recession of 2007 to 2009 many UHNWIs became merely high-net-worth individuals HNWIs meaning individuals with more than 1 million in net. For example within the last 20 years the Federal Estate Tax started taxing estates as small. For example suppose your estate is worth 125 million in 2022.

Web Ultra High Net Worth An ultra-high-net-worth individual is normally somebody with a. Life insurance is another critical consideration in UHNW estate planning both to pay estate taxes and to bequeath assets or funds to family members. Web For many people the focus on estate planning used to be to minimize estate tax.

Web Freeze lower value of assets for gifting purposes. Web A HNW individual will have between 1 million and 10 million in liquid net worth. For ultra-high-net-worth families making gifts today at the depressed market prices is an opportunity to.

Freeze lower value of assets for gifting purposes. A Report on Family Wealth Transfer report ultra high net worth UHWN individuals are most concerned by. High net worth is considered to be someone with at least 1M in liquid assets and an Ultra high net worth individual.

Web Search Ultra high net worth client. Ad Planning Can Help You Reach Your Goals And Feel More Confident Along The Way. Web For taxable amounts greater than 1 million federal estate taxes now top out at 40.

Web 38 Ultra High Net Worth Legacy Planning. The term UHNW refers to anyone who has over 10 million in liquid net worth. Web The estates of ultra-high-net-worth individuals and families those with assets of 30 million or more can be inherently complex so having a comprehensive estate plan is.

Releases New Study Uncovering Challenges For High Net Worth Individuals Succession Planning Transamerica Life Bermuda

The Dfh Group Tulsa Ok Morgan Stanley Wealth Management

Succession Planning In A Pandemic How Asia S Affluent Prepare For The Future Cna Luxury

Succession Planning In A Pandemic How Asia S Affluent Prepare For The Future Cna Luxury

What Are The Trends Shaping Estate Planning Right Now

90 Of Singapore High Net Worth Individuals Rely On Insurance To For Wealth And Legacy Planning According To Aia And Ey

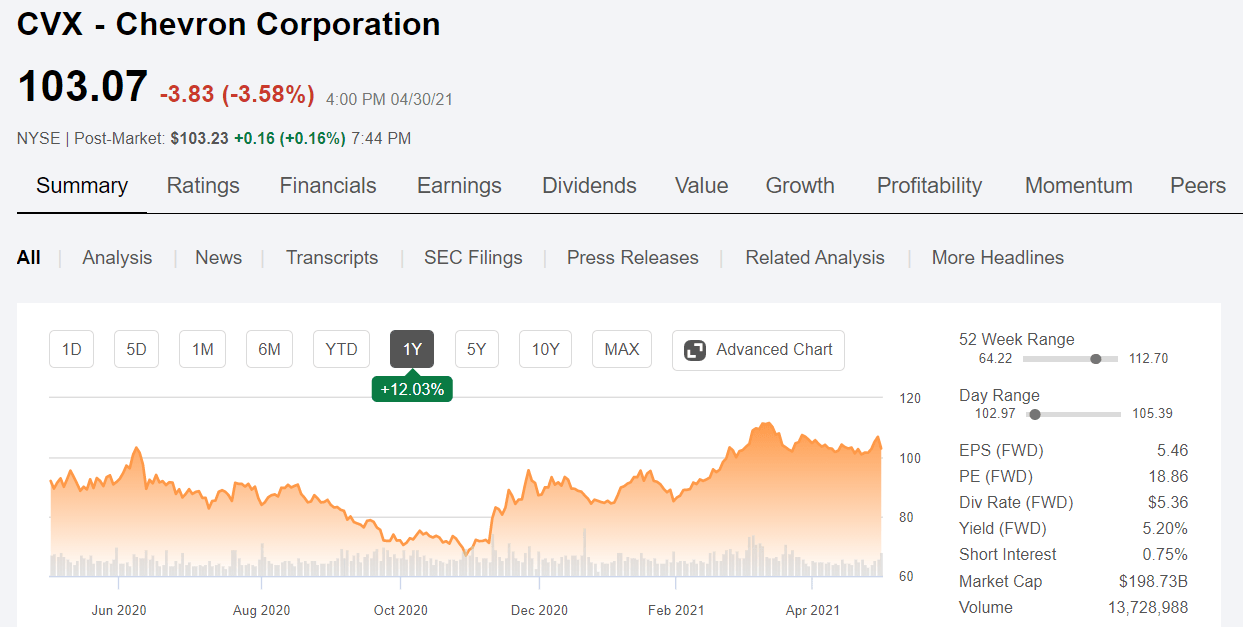

Chevron Cvx The Number One Energy Stock For Your Retirement Portfolio Seeking Alpha

Lifeandhomes Syracuse Ny September 2021 By Stephen Lisi Issuu

Why Succession Planning Is Important For Hnw Clients

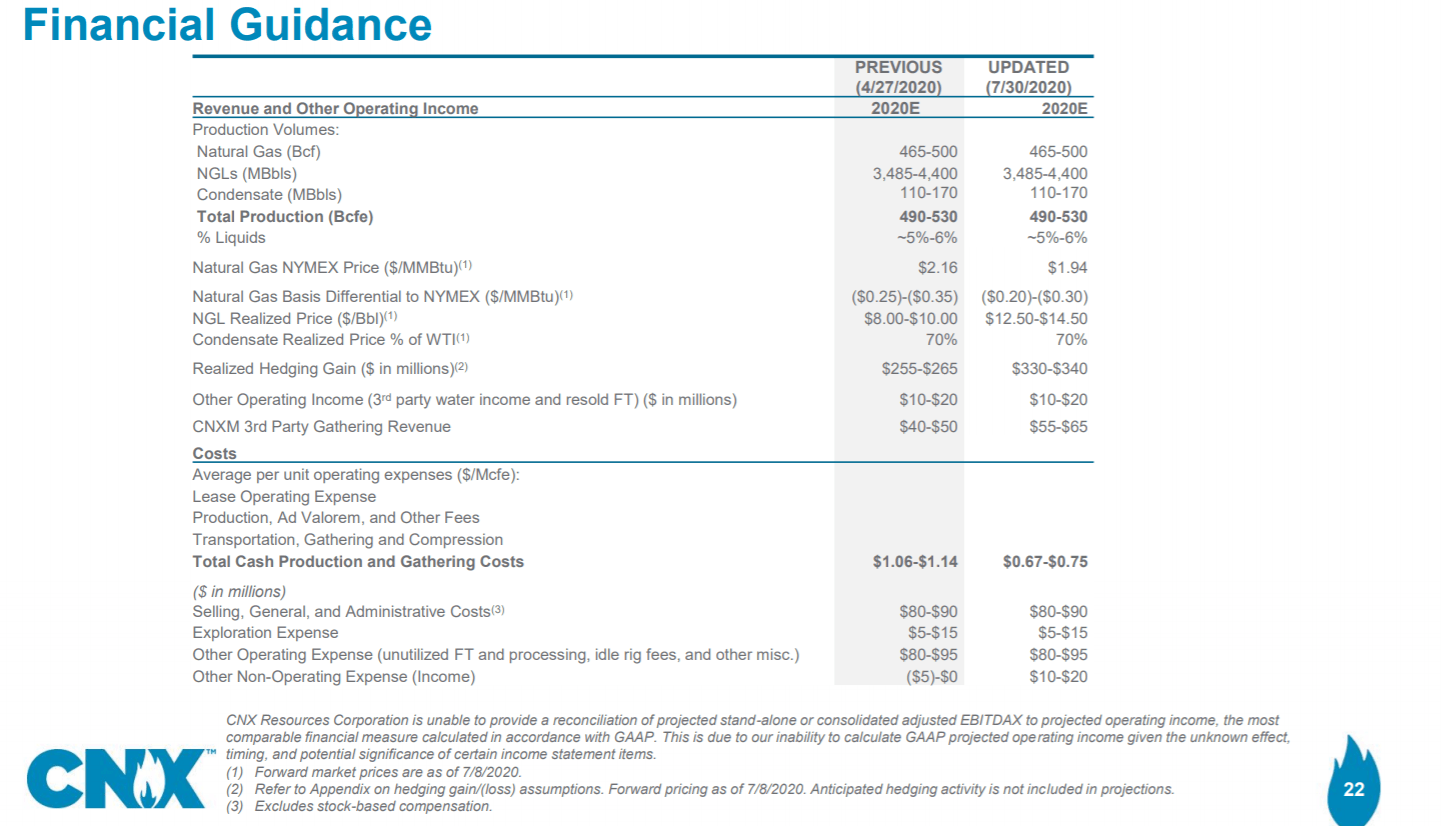

Cnx Resources Capital Efficiency And A Game Plan For Growth Nyse Cnx Seeking Alpha

7 Financial Planning Strategies For High Net Worth Americans

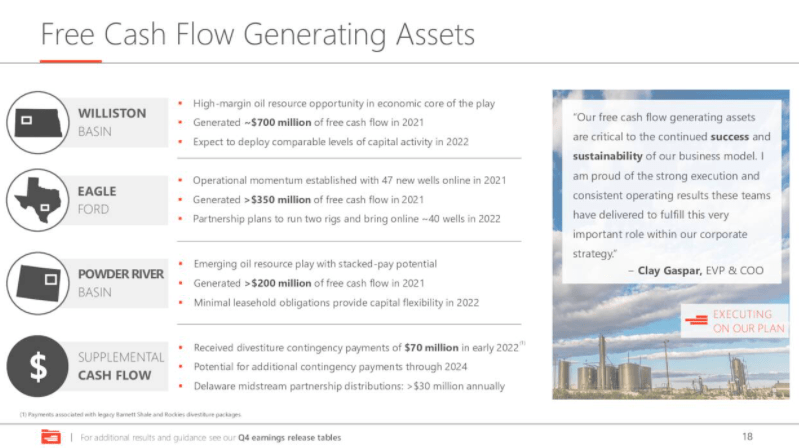

Devon Energy Rick Muncrief Hold For The President Please Nyse Dvn Seeking Alpha

How To Successfully Plan Your Legacy

Planning Ahead Three Key Wealth Strategies For High Net Worth Individuals In 2023

The Ultra High Net Worth Investor Coming Of Age Kkr

Black Marketing Network Facebook

Stop Using Env Files Now Dev Community